Millionaires on the Move: Where are the World’s Wealthy Migrating to and from in 2024?

By Henley & Partners

LONDON, June 18, 2024 /PRNewswire/ — The UK is expected to see an unprecedented net loss of 9,500 millionaires in 2024 — second only to China worldwide, and more than double the 4,200 who left the country last year, which was itself record-breaking following the exodus of 1,600 HNWIs in 2022. For the third year running, the UAE looks set to take first place as the world’s leading wealth magnet, with a record-breaking 6,700 moneyed migrants expected to make the Emirates home by the end of the year, boosted by large inflows from the UK and Europe.

The Henley Private Wealth Migration Report 2024, released today by international investment migration advisory firm Henley & Partners, features the most significant projected millionaire migrant inflows and outflows globally as well as the W15 ranking of the world’s top 15 countries for millionaires, centi-millionaires and billionaires.

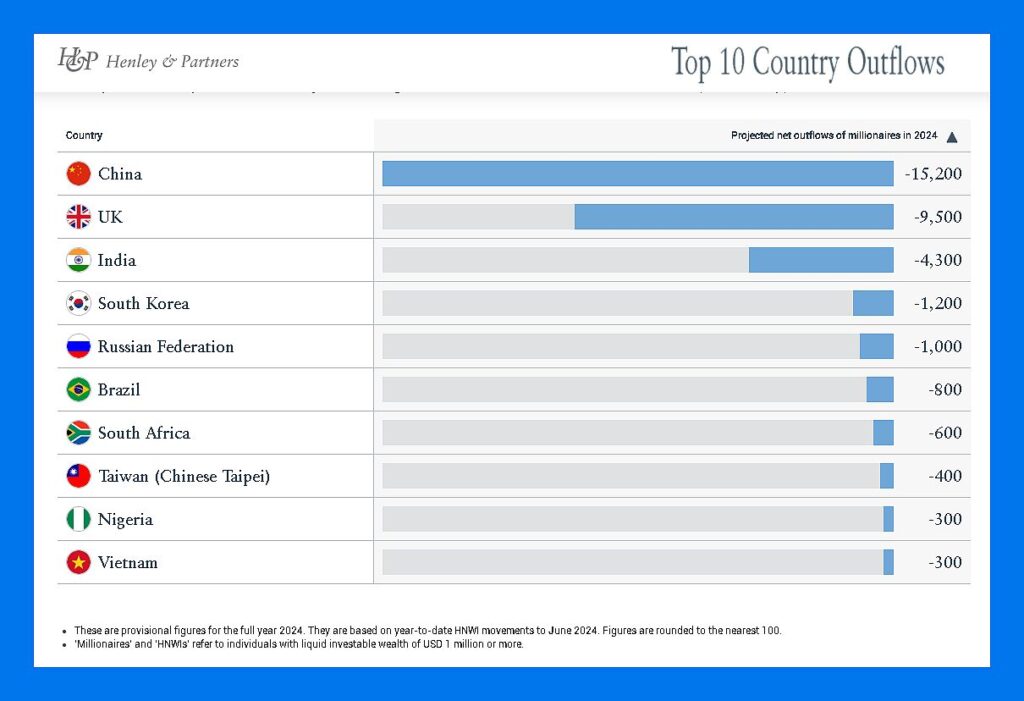

China is again on track to be the biggest millionaire loser globally, with an anticipated net exit of 15,200 HNWIs this year (compared to 13,800 in 2023) whereas India has stemmed its wealth exodus, dropping down to 3rd place after the UK with just 4,300 millionaires projected to leave the country in 2024 (compared to 5,100 last year). South Korea’s HNWI flight is expected to rise with a forecast loss of 1,200 millionaires (compared to 800 in 2023) while the tsunami of millionaires that fled Russia following the outbreak of the Ukraine war appears to be abating with only 1,000 projected to relocate this year (compared to 8,500 in 2022 and 2,800 in 2023).

Dominic Volek, Group Head of Private Clients at Henley & Partners, says 2024 is shaping up to be a watershed moment in the global migration of wealth: “An unprecedented 128,000 millionaires are expected to relocate worldwide this year, eclipsing the previous record of 120,000 set in 2023. As the world grapples with a perfect storm of geopolitical tensions, economic uncertainty, and social upheaval, millionaires are voting with their feet in record numbers.”

UAE remains world’s leading millionaire magnet

With its zero income tax, golden visas, luxury lifestyle, and strategic location, the UAE has entrenched itself as the world’s number one destination for migrating millionaires and is poised to attract nearly twice as many millionaires as its nearest rival, the US, which is projected to benefit from a net inflow of 3,800 millionaires in 2024.

Singapore takes 3rd prize again this year with net inflows of 3,500, while the perennially popular destinations for migrating millionaires, Canada and Australia, follow in 4th and 5th places with net inflows of 3,200 and 2,500, respectively. European favorites Italy (+2,200), Switzerland (+1,500), Greece (+1,200) and Portugal (+800) all make it into this year’s Top 10 for net millionaire inflows along with Japan, which is on course to welcome 400 wealthy migrants, boosted in part by an accelerating trend of Chinese HNWIs moving to Tokyo that started post-Covid.

The other big millionaire losers in 2024

Besides China, the UK, India, South Korea, and Russia, the remaining places in the Top 10 millionaire outflow ranking are taken up by Brazil where a millionaire drain of 800 is projected this year, followed by South Africa (-600), Taiwan (-400), and Vietnam and Nigeria, which are both set to see 300 millionaires take flight.

But as Dr. Hannah White OBE, Director and CEO of the Institute for Government in London points out, HNWIs are leaving these other countries for quite different reasons from the UK: “Both China and India are seeing high net outflows because of the success of their sizeable economies in generating new millionaires, although slowing wealth growth in China in recent years could mean sustained losses become more damaging over time. As do those from many other developing nations, including notably Brazil, Vietnam, South Africa, and Nigeria, Indian millionaires often depart the sub-continent in search of a better lifestyle, safer and cleaner environments, and access to more premium health and education services. Elsewhere, regional threats and uncertainty over the security stance of America following a potential Trump victory in the 2024 US presidential election in November mean that South Korea and Taiwan are continuing to see net outflows of HNWIs.”

The surge in millionaire migration is fueling a corresponding boom in the investment migration sector. Henley & Partners has received record levels of enquiries about residence and citizenship by investment programs over the past 12 months from nearly 200 different countries. The top two nationalities currently driving demand are Americans and Indians, with Brits, Filipinos, and South Africans remaining in the Top 10 as they have done for the last five years.