In recent years, a powerful shift has begun quietly reshaping Africa’s investment landscape — one led not by fast-moving venture funds, but by long-viewed family capital. Few observers understand this evolution more deeply than Ajay Wasserman, an African investment strategist and founder of Fio Capital, whose work sits at the intersection of patient capital, industry-building, and intergenerational stewardship. With decades of experience guiding families and enterprises across the continent, Mr. Wasserman is part of a growing movement redefining what meaningful investment in Africa should look like.

In this piece, Wasserman argues that Africa’s future will not be built by quick exits or hyper-growth expectations, but by patient, purpose-aligned family offices willing to stay the course — the kind of capital that nurtures industries, empowers founders, and builds lasting prosperity.

The Rise of African Family Offices!

“Africa doesn’t need more venture capital — it needs more patient family capital.”

For too long, Africa’s investment narrative has been dominated by venture capital — chasing quick exits, high returns, and fast growth.

But Africa’s greatest opportunities aren’t found in short-term plays.

They’re built through patient, purpose-driven capital that stays long enough to shape industries, empower entrepreneurs, and create generational impact.

💼 VC vs Family-Office Capital

Venture Capital:

⚡ Short-term, exit-driven, milestone obsessed.

💸 External LPs, 5-10 year horizons, rapid scaling.

Family Offices:

🌍 Long-term, values-driven, intergenerational.

🏗 Built for stewardship, legacy, and real-world impact.

In Africa, this shift matters — because building industries like energy, agriculture, healthcare, education, and infrastructure takes decades, not funding rounds.

🧭 Fio Capital’s Approach

At Fio Capital, we’ve adopted a buy-and-hold philosophy.

We invest patient family capital into core impact industries — creating jobs, driving inclusion, and building sustainable African enterprises.

We don’t just invest in Africa.

We invest with Africa — alongside founders and families who share a vision of conscious, generational wealth creation.

🌱 From Wealth Preservation to Impact Creation

A mature family office isn’t just about protecting assets — it’s about preserving purpose.

Wealth without wisdom fades.

Stewardship ensures legacy.

Africa’s next generation of family offices is redefining success — not in terms of ROI alone, but in return on impact, return on integrity, and return on community.

🏆 5 African Family Offices to Watch

1️⃣ Heirs Holdings (Nigeria) — Tony Elumelu’s family office driving investments in power, finance, and healthcare.

2️⃣ Tengen Family Office (Nigeria) — founded by Aigboje Aig-Imoukhuede & Herbert Wigwe, focused on long-term value creation.

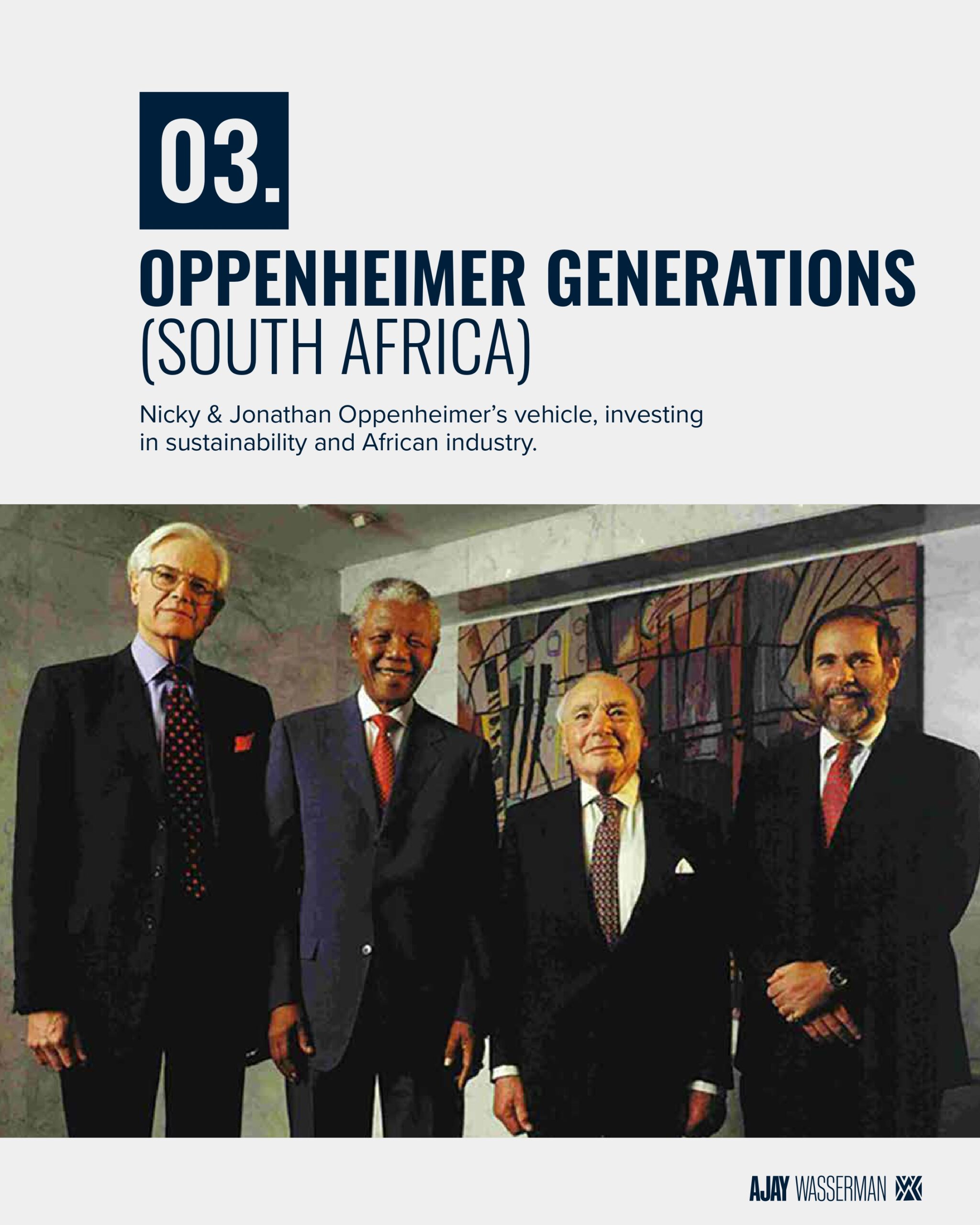

3️⃣ Oppenheimer Generations (South Africa) — Nicky & Jonathan Oppenheimer’s vehicle, investing in sustainability and African industry.

4️⃣ Dangote Family Office (Nigeria) — Aliko Dangote’s global expansion vehicle for African industrial growth.

5️⃣ Mary Oppenheimer Daughters (South Africa / UK) — diversified investments across private equity and real assets.

© Ajay Wasserman 2025